FintechZoom AMC Stock Ultimate Guide And Analysis

As a result of this meteoric rise, FintechZoom AMC stock has captivated investors, analysts, and the public. It has sparked debates regarding market manipulation and the influence of online communities. As FintechZoom covers AMC stock, it emphasizes the intersection of technology and finance, providing timely updates and insights into the market.

This dynamic market requires an understanding of the key players driving AMC’s surge, including institutional and retail investors. AMC stock’s future performance will be influenced by technological advancements, consumer preferences, and shifting market conditions.

Social media platforms have significantly impacted investor sentiment and democratized access to market information. For investors aiming to navigate the volatile stock market landscape, understanding these elements is essential.

Investing in FintechZoom AMC Stocks

FintechZoom reports that the unprecedented rise in AMC stock prices has captivated the financial sector with its unique dynamics and implications. FintechZoom has highlighted the phenomenon of AMC stocks as a central topic for discussion and speculation, attracting investors, analysts, and the general public’s attention.

Platforms such as FintechZoom have enabled this sudden price increase, leading to debates over market manipulation, online communities, and traditional investing. This phenomenon presents a unique opportunity to democratize information and trading.

Also check: Understanding Fintechzoom Tesla Stock

By facilitating participation in ways previously reserved for institutional players, online platforms have challenged conventional wisdom about the efficiency and fairness of the market for retail investors.

It serves as a reminder that financial markets are evolving and technology is increasingly influencing investment decisions as the AMC stock saga unfolds. Anyone seeking to navigate the ever-changing financial world needs to understand the complexities and implications of this trend.

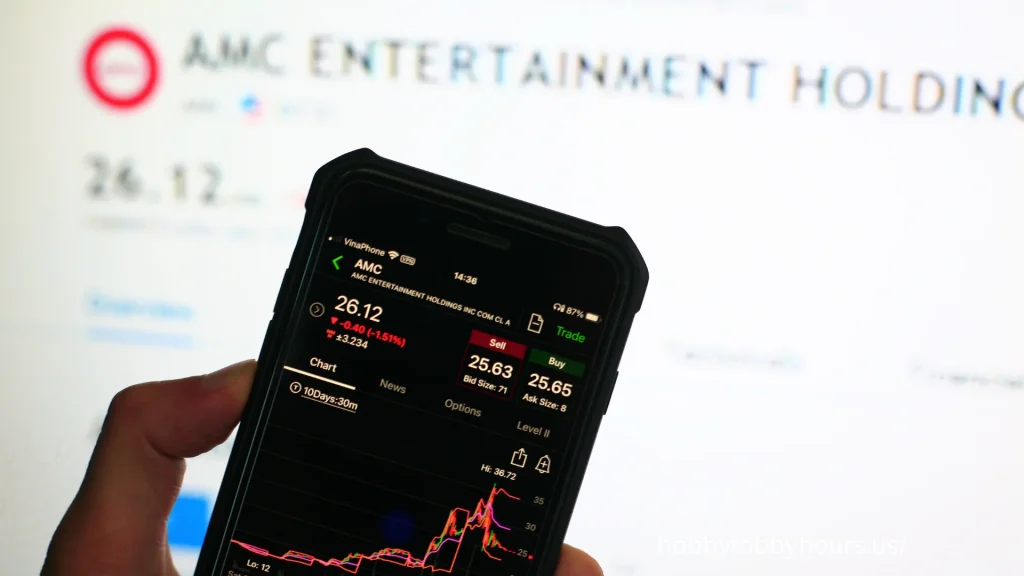

Live FintechZoom AMC stock prices and analyst predictions

Analysts remain split on the long-term outlook for AMC’s stock, despite the recent rise in prices. According to some analysts, the company’s financial difficulties and changes in consumer behavior (such as streaming services) could hinder its expansion in the near future. The massive footprint of AMC and the recognition of its brand in a post-pandemic market give it a competitive edge.

A variety of analyst forecasts are provided by Fintech Zoom, ranging from bullish to bearish. For readers to better understand AMC’s stock price, it regularly provides the latest developments along with expert advice and data-driven information.

Trends in the current market

Recently, AMC stock has seen unprecedented growth. The company was on the verge of bankruptcy due to the economic impacts of COVID-19 on theaters. To boost the value of their shares and prevent the company from going bankrupt, investors from Reddit’s r/WallStreetBets forums joined forces.

The AMC stock gained over 1,000% between January 2021 and July 2021, according to FintechZoom’s study. There are a number of factors contributing to the improvement, including an increase in interest in live entertainment following the COVID-19 lockdowns, as well as a brief reduction in hedge funds, among others. Analysts and investors are following AMC’s stock performance closely, and this trend has not gone unnoticed.

Analyzed in comparison with other sources

FintechZoom is regarded as a reliable source for accurate and current information about AMC’s stock price performance. There is a lot of information and opinions about AMC’s shares.

The FintechZoom research can be compared with other publications, which allows users to gain a complete understanding of AMC’s current situation. Analysts and investors can use the comparison tool to get a thorough overview of the company’s financial growth.

Coverage of AMC stock by FintechZoom

FintechZoom’s impact on AMC stock coverage illustrates how technology and finance are converging to shape market narratives. Providing real-time updates, analysis, and insights into AMC stock, FintechZoom empowers both seasoned investors and newcomers with financial information.

The FintechZoom platform combines traditional financial journalism with modern technology, presenting a comprehensive picture of AMC’s stock performance. In this article, we examine the intricate dynamics of AMC’s stock price rollercoaster, which are influenced by factors like retail investor interest, short squeezes, and market sentiment as a whole.

By analyzing AMC’s price movements in depth, FintechZoom helps investors understand the reasons behind AMC’s erratic movements. FintechZoom continues to provide timely updates and in-depth analysis of AMC’s price action as it continues to draw attention from Wall Street and Main Street. With this knowledge, the audience can navigate the volatile stock market with confidence and clarity.

The key players behind AMC’s growth

Understanding the key players behind AMC stock’s price surge is key to unraveling the complex web of AMC stock’s price fluctuations. Through online platforms such as Reddit’s WallStreetBets, retail investors have become a formidable force. Through coordinated stock buying and holding, their collective actions contributed significantly to the rise of AMC’s stock price.

Also check: Guide to FintechZoom Google Stock

AMC’s surge can be attributed to institutional investors, including hedge funds and large financial firms. Their actions, whether short-selling or buying into the company, have a significant impact. It is the interaction and conflicts between institutional and retail investors that contribute to AMC’s stock price’s volatility and unpredictability.

Investors wishing to navigate AMC’s market complexities effectively must understand these key players’ motivations and strategies.

Social media’s impact on AMC stock

Investor sentiment and market dynamics have been reshaped by social media platforms, which have played a significant role in AMC stock price fluctuations.

Through platforms such as Reddit, Twitter, and TikTok, individual investors are able to take collective action to influence stock prices, which has led to a new era of collective action. AMC was particularly affected by this phenomenon, as enthusiastic online communities rallied behind the stock, driving up its price.

By democratizing market information, social media has empowered individual investors to challenge traditional financial institutions. In spite of this newfound power, retail investors can still have a significant impact on the market, even when price movements are rapid and sometimes volatile.

To navigate the evolving landscape of stock trading influenced by online platforms, staying informed, critically evaluating information, and making well-informed decisions are essential.

Impact of Reddit Community

It is believed that Reddit plays a significant role in the stock’s volatility. WallStreetBets’ community of retail investors has expressed their enthusiasm for the company, often encouraging others to buy and hold shares. In turn, public opinion on social media can significantly influence the price of a stock, resulting in a phenomenon known as meme stocks.

A detailed analysis of the influence of the Reddit community on this particular aspect of the AMC story has been provided by FintechZoom. The Fintech Zoom has also stressed the dangers of investing in meme stocks. Readers are advised to proceed with caution when making these investments.

The response of Wall Street to AMC

Social media has spurred a surge in retail investor activity, which has led Wall Street to closely examine AMC Entertainment Holdings’ stock performance. Retail investors rallied behind AMC, driving significant volatility in its stock price, forcing traditional Wall Street institutions to adapt to this evolving market landscape.

It was initially believed that AMC would fail, so some hedge funds and institutional investors took short positions. The stock price surged as retail investor enthusiasm prompted some Wall Street players to recalibrate their positions, either by closing short positions or even joining the buying frenzy as the stock price rose.

Market dynamics, institutional strategies, and risk management practices are all intertwined in Wall Street’s response to AMC. Adaptability and agility are essential in a rapidly changing market. As AMC’s stock performance illustrates, power dynamics are shifting in today’s market environment due to the evolving relationship between retail investors and traditional financial institutions.

Stock performance lessons from AMC

The stock performance of AMC Entertainment Holdings offers valuable insight for investors navigating today’s complex market landscape. Retail investor interest has fueled enormous volatility, as well as short squeezes and meme stocks.

Among the key lessons from AMC’s stock performance is how retail investors can influence stock movements through social media, challenging traditional Wall Street dynamics. Understanding market sentiment and momentum is another important lesson to learn.

AMC’s stock price movement has often defied fundamental analysis, demonstrating how investor emotions and collective behavior influence stock valuations. Moreover, AMC’s extreme price fluctuation underscores the need for portfolio diversification and risk management.

The future of AMC stock according to FintechZoom

AMC Entertainment Holdings’ future trajectory can be predicted by combining fundamental analysis, industry trends, and market sentiment. Several factors will influence AMC’s future performance, including technological advances, consumer preferences, and economic conditions as a whole.

Streaming services, changing viewer habits, and the ongoing impact of the pandemic on movie theater attendance may cause AMC to experience volatility. As restrictions ease and blockbuster films bring audiences back to theaters, many remain optimistic about AMC’s future.

Investors should carefully assess the risks and opportunities before making a decision about AMC stock, as the future remains uncertain. It is essential to stay informed, diversify portfolios, and develop a long-term investment strategy to navigate AMC’s future.

Investing Safely in Volatile Stocks with FintechZoom AMC Stock

Research, understanding the company’s fundamentals, and staying up to date on market trends are important for managing fluctuations in volatile stocks like AMC.

In order to mitigate risks, investors need to diversify their investments across different assets so that potential losses can be cushioned. It is important to establish a clear risk tolerance and set clear goals. The use of stop-loss orders allows investors to limit their losses by automatically selling stocks at a predetermined price. Keeping discipline and avoiding emotional decision-making are crucial in volatile markets.

Keeping up with the latest news and developments related to AMC can provide valuable insight for making investment decisions. Investing in volatile stocks safely can be guided by financial advisors and experienced investors. An investor can maximize opportunities and manage risks effectively if he or she approaches volatile investments with caution and a well-thought-out strategy.

AMC’s Stock Movement Legacy

Market forces and investor sentiment play a dynamic role in AMC’s stock movement, which has left a lasting impact on the financial industry. Due to its reliance on in-person movie experiences, AMC Entertainment Holdings’ stock price fluctuated substantially in response to shifting market dynamics and investor behavior following the COVID-19 pandemic.

With the unprecedented rise in retail trading activity fueled by social media platforms and online communities, AMC’s stock reached unprecedented heights, challenging traditional notions of market efficiency and stock valuation. Throughout history, the AMC stock movement has demonstrated the power of collective action and the influence of retail investors on market trends.

Underscoring the importance of democratizing access to investment opportunities, it illustrates the potential for individual investors to band together and challenge established financial institutions. With the lessons learned from AMC’s stock movement, a new generation of investors will be inspired to redefine the future of investing as it continues its recovery journey.

Frequently Asked Questions

When selecting AMC stock news to cover, how does the FintechZoom platform decide what to cover?

To ensure informative and valuable content, platforms prioritize relevant, impactful, and timely AMC stock news. Market trends, company performance, and audience interest guide the selection process.

Through FintechZoom coverage, can social media influencers manipulate the AMC stock price?

Stock prices can fluctuate dramatically when social media personalities influence them, sparked by media coverage. Vigilant monitoring is essential to keep an eye on this impact.

Do FintechZoom’s reports on AMC stock raise any regulatory concerns?

Media outlets reporting on stock prices may raise regulatory concerns. Transparency, accuracy, and ethical considerations are paramount. Regulation is intended to protect investors and ensure fair markets.

FintechZoom’s Coverage of AMC Stock: What Are the Long-Term Implications?

Investing decisions are shaped by the long-term implications of media coverage. Although thoughtful reporting fosters informed decisions and market stability, sensationalism may foster volatility and misinformation.

In what ways does FintechZoom ensure that AMC stock information is accurate and unbiased?

It is essential to check factual accuracy, verify multiple sources, adhere to journalistic ethics, avoid conflicts of interest, and maintain transparency in reporting processes in order to maintain objectivity and integrity.

Conclusion

Despite AMC’s rollercoaster stock price, key players and social media have played an important role in its surge, as FintechZoom has covered the stock. As the adage goes, “the proof is in the pudding,” highlighting the importance of diligence and caution when investing in volatile stocks. AMC’s performance can provide investors with valuable lessons for making informed decisions.