Understanding FintechZoom GME Stock: Comrehensive Analysis

With FintechZoom, you’ll find a wide variety of financial news and information on stocks, cryptocurrencies, banking, and fintech from leading news and information providers. When the unprecedented short squeeze event in early 2021 brought widespread attention to GameStop Corp.

FintechZoom GME stock was one of the most talked-about stocks featured on FintechZoom. By explaining FintechZoom and GME stock, as well as the events surrounding the GME short squeeze, this article aims to provide a thorough understanding of both stocks.

FintechZoom GME Stock Live Stocks:

What is FintechZoom?

A leading online platform dedicated to delivering the latest financial news and analysis, FintechZoom covers a wide range of industries within the finance industry, including but not limited to:

- Updates on the stock market: Information on stock market movements, company performance, and investment opportunities.

- News about cryptocurrency: Market analysis, regulatory updates, and latest trends for the crypto world.

- Innovations in banking and finance : News about fintech startups, digital banking solutions, and new technologies.

- Tips on personal finance : Investing, retirement planning, and managing your finances.

Investors, traders, and financial enthusiasts find FintechZoom to be an invaluable source of up-to-date financial information.

Also check: FintechZoom Apple Stock Analysis

Stock overview for GameStop (GME)

The company is headquartered in Grapevine, Texas and specializes in video games, consumer electronics, and video game merchandise. In the past, GameStop operated physical stores, but it faced challenges due to the shift towards digital gaming and e-commerce.

The stock symbol GME represents shares of GameStop Corp., which specializes in video games, gaming merchandise, and consumer electronics. Retail investors initiated a short squeeze on platforms like Reddit, which resulted in significant price volatility for the stock.

The history of GME stock

As a brick-and-mortar retailer for a long time, GameStop faced significant challenges when digital downloads and online retail began. The company was founded in 1984 and went public in 2002.

As a result of retail traders coordinating over social media in early 2021, GME stock skyrocketed from under $20 to over $300 within weeks.

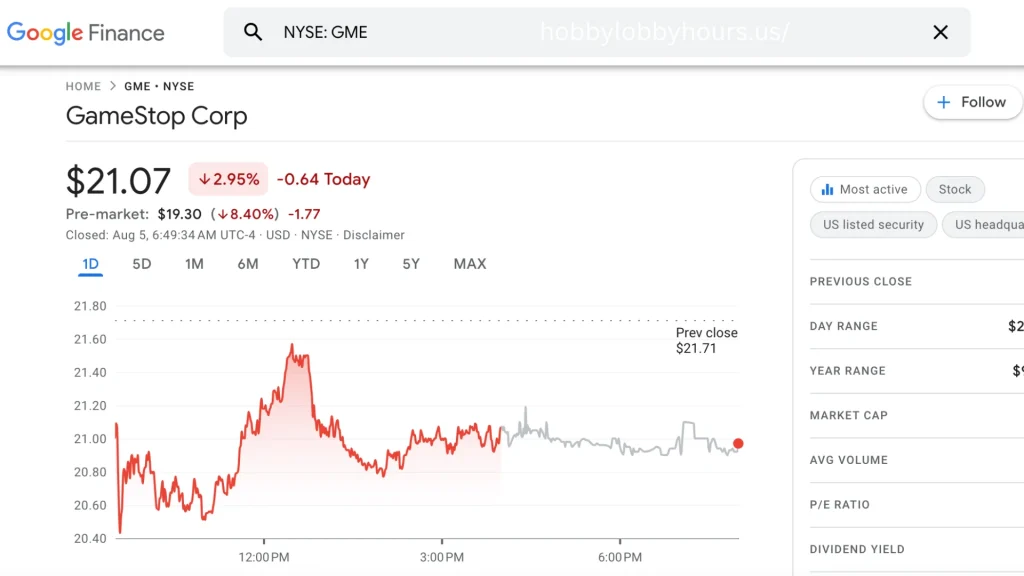

Updated price for GME stock in August 2024

GME stock traded at $23.60 per share on 5th August 2024. The stock has seen fluctuations due to company strategy changes and shifts in the gaming industry, as well as broader economic conditions.

Short Squeeze Phenomenon in the GME

Retail investors primarily communicating through the Reddit subreddit WallStreetBets orchestrated a dramatic short squeeze on GME stock in early 2021. Here’s a breakdown of the events:

- Background:

- Stocks of GameStop were heavily shorted by institutional investors, meaning they bet against the stock.

- Profits are made by selling shares at a lower price and then buying them back at a higher price.

- The Short Squeeze:

- Investors began purchasing GME shares in mass after noticing the high short interest.

- Further fueling the price surge was the fact that short sellers had to cover their positions by purchasing shares back at higher prices as a result of this buying frenzy.

- Market Impact:

- Early in January 2021, GME’s stock price was around $20, but by late January it had reached an all-time high of $483.

- Market manipulation, the role of social media in trading, and hedge funds’ practices were all discussed during the event, which highlighted the power of retail investors.

The GME saga’s broader implications

Several significant financial market implications resulted from the GME short squeeze:

- Scrutiny by regulators: After the event, regulators, such as the SEC, investigated the trading practices and market dynamics.

- The volatility of the market : Instability surrounding GME and other “meme stocks” affected other stocks and sectors.

- Empowerment of Retail Investors : GME’s price rise was a testament to the growing influence of retail investors in a traditionally institutionalized market.

- Responses of Brokerage Platforms: Brokerage platforms such as Robinhood faced backlash for restricting trading in GME and other stocks.

Also check: Understanding FintechZoom Costco Stock

Investment benefits of GME stocks

- Potential for High Returns: GME stock can produce substantial returns over a short period of time due to its volatility.

- Retail Investor Influence: There is a large retail investor base for the stock, which can lead to rapid price increases.

- Company Transformation: Digital gaming and e-commerce are key growth opportunities for GameStop.

Risks of GME Stock Investment

- High Volatility: GME stock has extreme price swings, which pose a significant risk.

- Market Speculation: Stock prices are often driven by speculation rather than fundamental factors.

- Company Challenges: GameStop continues to face challenges in adapting to the digital market.

GME Stock Predictions for the Future

It’s important for investors to keep an eye on company developments and market trends to determine how the stock will perform in the future. Some experts believe the company’s digital transformation will lead to growth, while others warn that future declines are likely.

Guidelines for Investing in GME Stocks

- Research: Identify the business model, financials, and market position of GameStop.

- Analyze Market Trends: Stay up-to-date on gaming industry news and trends.

- Evaluate Risk Tolerance: Determine whether you can handle the volatility of the stock.

- Set Investment Goals: Decide how long you want to invest and what returns you are seeking.

- Choose a Broker: Ensure that the brokerage platform offers GME stock trades.

- Monitor Stock Performance: Keep an eye on GME’s stock price and the market’s current conditions on a regular basis.

- Stay Informed: Keep up with GameStop news and industry updates.

Conclusion

Financial history is marked by the GME stock saga, extensively covered by platforms such as FintechZoom. As a result of coordinated retail investor actions, institutional players were challenged and ongoing discussions about market regulations and trading practices were highlighted. As a vital resource for anyone interested in financial markets, FintechZoom continues to provide updates and insights on such events.

Investors can better navigate the complexities of modern finance by understanding FintechZoom and the intricacies of the GME short squeeze.