Comprehensive And Detailed Guide to FintechZoom Google Stock

When it comes to investing in the stock market, Google is the first and foremost choice. Although this is one of the fastest-growing organizations in the world, you need an index platform and the right approach to make a profitable investment. FintechZoom is a suitable platform for that, since it offers a variety of functions.

Next, let’s discuss FintechZoom’s scope, its advantages, and the risks associated with FintechZoom Google stock analysis.

FintechZoom and Google Stock: what are they?

FintechZoom offers a variety of financial services to simplify finances and make money management simpler, smarter, and more fulfilling. Real-time financial data, news, and analytics are among the services provided by the service, along with market trends and stock performance alerts.

Live Google Stock:

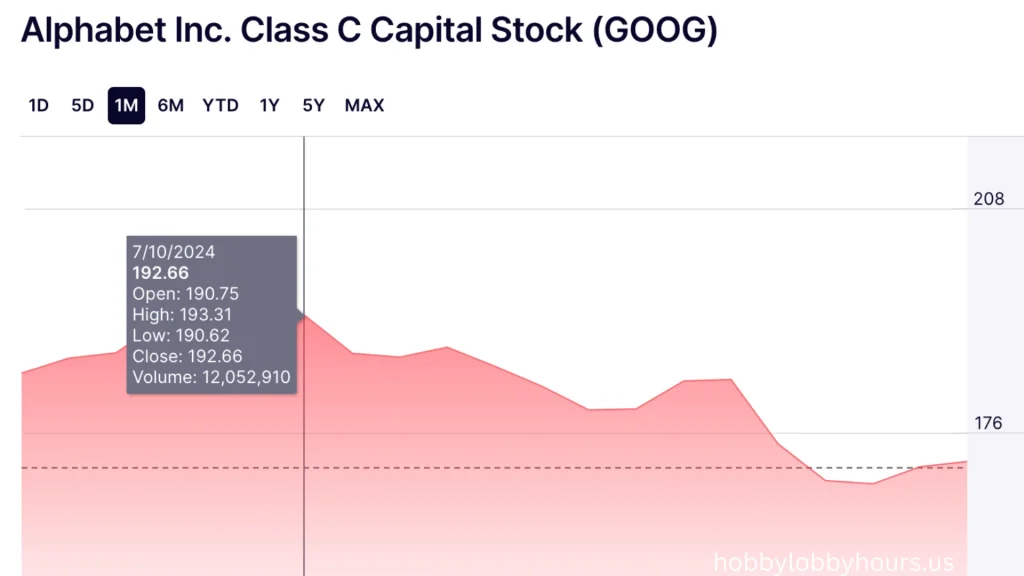

GOOG and GOOGL, which are the stock symbols of Alphabet Inc., the holding company of Google, constitute the majority of Google stocks. A shareholder’s decision-making power determines the type of stock Alphabet issues. The holders of GOOGL have voting rights in the decision-making process, whereas the holders of GOOG do not.

Potential investors need a platform like FintechZoom to educate them about the latest and necessary updates about the status of stocks like GOOG and GOOGL based on their market values.

FintechZoom’s features

FintechZoom offers the following features to enhance the user experience:

- An easy-to-use interface: FintechZoom facilitates easy navigation for its audience through a user-friendly interface.

- Trading: With the platform’s integration with brokerage platforms, users can trade directly from the app.

- Stock index: It offers loans, investments, cryptocurrency, blockchain technology, digital banking, and payments.

- News content: Fintechzoom provides readers with up-to-date news, in-depth articles, market analysis, and instructional materials on the fintech industry.

- Analytical tools: There are a number of analytical tools available on the platform, such as technical indicators, charting functions, and financial ratios.

What Google does and where it stands in the market

Advertising dominance

Approximately half of Google Inc.’s revenue comes from Google Ads, a platform that is crucial for businesses worldwide, driving traffic and sales, thus confirming Google’s market dominance. With its innovative strategies and extensive reach, the company ensures continuous revenue growth.

Growth and diversification

As Alphabet continues to diversify and innovate, its investment in projects like Waymo (self-driving cars), Verily (life sciences), and Calico (longevity research) highlights its focus on innovation and diversification.

Factors affecting the economy and the market

The influence of stock prices on the economy

Economic conditions, technological advancements, and market trends all influence Google’s stock price. Investor sentiment is shaped by factors such as economic growth, interest rates, and artificial intelligence (AI). Over the years, Google has boosted its stock value and market position through strategic acquisitions like YouTube and Android.

Comparative Analysis of Other Tech Giants

Apple, Amazon, and Microsoft have different growth profiles, so understanding Google’s position relative to other tech giants provides valuable insights. There are some useful comparisons between Apple’s consumer electronics focus, Amazon’s e-commerce dominance, and Microsoft’s enterprise solutions and cloud services. It helps investors understand the broader tech market dynamics and diversify their portfolios.

Google Stock Investing Strategies

Investments with a long-term view

The company’s continuous growth and resilience make Google an attractive investment option for long-term investors seeking steady returns.

- Stock Price: Google’s stock price as of July 2024 is $185.07, reaching a 52-week high of $193.31.

- Analyst Ratings: 39 analysts rate the stock “Buy” with a 12-month price target of $191.24, suggesting that the stock could increase 6.71% from its current price.

- Market Capitalization: The market capitalization of Alphabet is approximately $1.55 trillion.

- Revenue Growth: In its latest quarterly report, Alphabet reported an increase of 15.4% in revenue year-over-year.

- Earnings per Share (EPS): Google reported $1.89 EPS, exceeding the consensus estimate of $1.51.

Investing in the short term

Investors can take advantage of market fluctuations and earnings reports to make informed decisions in the short term. A long-term investment strategy should be balanced with frequent updates in order to avoid impulsive decisions.

What are the benefits of using FintechZoom for Google Stock Analytics?

This platform, FintechZoom, offers several advantages that can be very helpful to investors analyzing Google’s stocks. Here are the reasons why you should invest in Google’s stock with FintechZoom.

Monitoring in real-time

FintechZoom tracks the GOOGLE stock in real-time, allowing investors to monitor the latest status, fluctuations, and price changes in order to stay up to date with the market.

A comparison of Google’s stock performance with those of its competitors on this platform further aids users in understanding the relative strength and market position of Google.

Insights into investments

This platform analyzes data on Google’s stock, including market news, analyst reports, historical prices, and financial measures. This data analysis helps investors gain a better understanding of what influences Google’s stock price.

Insights into Google’s long-term investment potential are provided by FintechZoom by considering actors such as the innovation pipeline, expansion into new markets, and sustainability initiatives. These insights enable investors to assess the growth potential of Google’s stock over time.

An in-depth analysis

FintechZoom provides in-depth research on Google’s financial performance, covering key metrics including revenue growth, profitability margins, earnings per share (EPS), and cash flow patterns. By analyzing GOOGLE’s financial health and growth prospects, investors can make informed decisions.

A variety of technical analysis tools are available at FintechZoom, including the relative strength index (RSI), Bollinger Bands, etc. RSI can, for example, be used to determine whether a stock is overbought or oversold, so investors can analyze trends and identify patterns in Google stocks.

Notifications tailored to your needs

A Fintechzoom investor can set up personalized alerts to receive timely market information, including price fluctuations and volume changes.

An individual can, for example, set up notifications when the Google stock price reaches a certain level, allowing him to take advantage of potential purchases or sales.

Latest News

FintechZoom keeps you up to date on Google-related news, including announcements of new products, business announcements, significant market events, etc., to make the right investment selection. In addition to keeping investors informed of the most recent events that could influence Google’s stock price and market mood, such news keeps them informed.

Stock risks associated with Fintechzoom

Even when investing in a company like Google, stock investments are known to involve risks. Here are some of those risks.

- Technological Changes: With technological advancements and innovations always on the rise, staying up to date has become increasingly important for Google. In order to remain competitive, Google must continue to innovate and adapt to new technologies. In the absence of this, it may lose a section of the industry, miss out on new learning opportunities, and reduce its stock price.

- Cybersecurity: Almost everyone knows how dangerous online security threats have become. Even large companies like Google have difficulty safeguarding their information from data breaches and unauthorized access. Google’s stock price may decline if a significant security breach occurs, as investors lose faith in the company and its reputation is damaged.

- Reliance on Advertising Revenue: The Google stock price can suffer if online advertising spending is reduced from users due to consumer behavior changes or increased competition from other businesses.

- The Volatility of the Market: It is important to note that a company’s stock value is affected by a wide range of factors, including economic events, sudden shifts in market attitudes, global events, government policies, etc. By preparing for probable swings and implementing risk management methods in advance, investors can reduce the effects of volatility.

- Competition: It impacts Google’s ability to sustain a competitive advantage and promote growth in various areas, such as search, promotion, distributed computing, and equipment.

Case studies on Fintechzoom Google Stock

FintechZoom’s platform has benefited numerous people. Here are a few success stories.

Case study 1

Robin finds FintechZoom’s real-time data and analysis quite valuable. FintechZoom gives Robin a competitive edge in the market. He uses the program to track market trends, appraise stocks, and make informed investment decisions. Since FintechZoom has been integrated into Robin’s investment process, its portfolio performance has dramatically improved.

Case study 2

An Alphabet user activated the personalized notification option on FintechZoom to learn about the company’s quarterly earnings. The platform provided him with a detailed report and a real-time notification, enabling him to act accordingly. In the event that the company’s earnings exceeded the predetermined amount, he bought more shares. With FintechZoom, he was able to make a lot of money.

The Future of FintechZoom and Google Stock

There is more to the platform than the aforementioned features. FintechZoom and Google Stock will both feature the following enhancements in the near future.

Machine learning and artificial intelligence

The Fintech sector in the modern world is experiencing the highest growth rate. In the future, platforms like FintechZoom might include technological advances such as blockchain, artificial intelligence, and machine learning, allowing users to access more advanced tools. In addition to enhanced predictive analytics, personalized investment guidance, automated trading algorithms, and much more, investors will likely benefit enormously.

A History of Alphabet’s Growth

With Alphabet’s creative thinking and clever financial decisions, Google stock is expected to perform well in the future. Autonomous vehicles, quantum computing, and artificial intelligence are a few areas where people will advance.

Conclusion

A platform like FintechZoom plays a vital role in stock investments, whether it is for Google’s stock or any other stock. They provide features such as the latest news, personalized notifications, real-time tracking, and analysis of investments. Additionally, future advancements are expected to improve the user experience in FintechZoom, including artificial intelligence, machine learning, and blockchain technologies.

It’s important to remember that investing has risks, even Alphabet stock (GOOGL & GOOG) is not completely risk-free. Make sure you do your research before making a decision.a