Understanding Fintechzoom Tesla Stock – Detailed Guide & Analysis

As a leading electric vehicle company, Tesla strives to be environmentally responsible in new and better ways. The company’s impressive technology and ambitious ideas attract investors and customers. Tesla’s stock fluctuates a lot, demonstrating the significant risks and rapid changes in the technology industry.

You can find all you need to know about investing in Tesla stock on Fintechzoom, a leading financial news portal that closely monitors Tesla’s stock. This blog tells you everything you need to know about investing in Tesla stock on Fintechzoom.

Fintechzoom Tesla Stock Updates in Real-Time

How does Tesla work?

A company that produces electric vehicles and renewable energy, Tesla was founded in 2003 by engineers Martin Eberhard and Marc Tarpenning. Tesla is led by Elon Musk as CEO. The company designs and manufactures electric vehicles, battery energy storage devices, and solar panels.

Autopilot is an intelligent driver assistance system that is available on Tesla’s Model S, Model 3, Model X, and Model Y vehicles.

With Tesla’s technology, self-driving taxis could be delivered in the future, rivaling ride-hailing companies like Uber.

Shares of Tesla are on the rise

Here is a brief history

Tesla’s journey in the stock market has been nothing short of extraordinary. The company went public on June 29, 2010, at a price of $17 per share. At that time, many investors were skeptical about its prospects, given the nascent stage of the electric vehicle (EV) market and the significant capital required to scale production. However, those who believed in Elon Musk’s vision and invested early have seen astronomical returns.

Key Milestones

Tesla’s stock has been marked by several key milestones that have driven its valuation:

- Model S Launch (2012): The introduction of the Model S sedan proved that Tesla could produce a high-performance, desirable electric car, boosting investor confidence.

- Gigafactory Announcement (2014): The announcement of the Gigafactory in Nevada underscored Tesla’s commitment to scaling battery production, a critical component for EVs.

- Model 3 Release (2017): The more affordable Model 3 broadened Tesla’s market, driving significant sales growth.

- Inclusion in S&P 500 (2020): Tesla’s inclusion in the S&P 500 index was a major milestone, attracting a new wave of institutional investors.

Stock Performance

Tesla’s stock performance has been volatile but generally on an upward trajectory. For instance, in 2020, Tesla’s stock price surged by over 700%, fueled by strong sales, the launch of new models, and increasing market confidence. FintechZoom has closely tracked these developments, providing timely analysis and insights to its users.

Understanding Tesla Stock

Tesla’s stock is among the most closely followed and actively traded stocks globally. Its unstable stock price shows the high risk/high return aspect of investing in technology and innovation-driven businesses. Tesla’s stock held up well despite the difficulties in Q1 2024, such as production issues and fewer deliveries than expected. Investors are closely monitoring the company’s performance and possibilities for future growth.

As the CEO of Tesla, Elon Musk has a big influence on the company’s stock price through his announcements and actions. Some examples are changes to the company’s product range which includes the Cybertruck and improvements in autonomous driving technology.

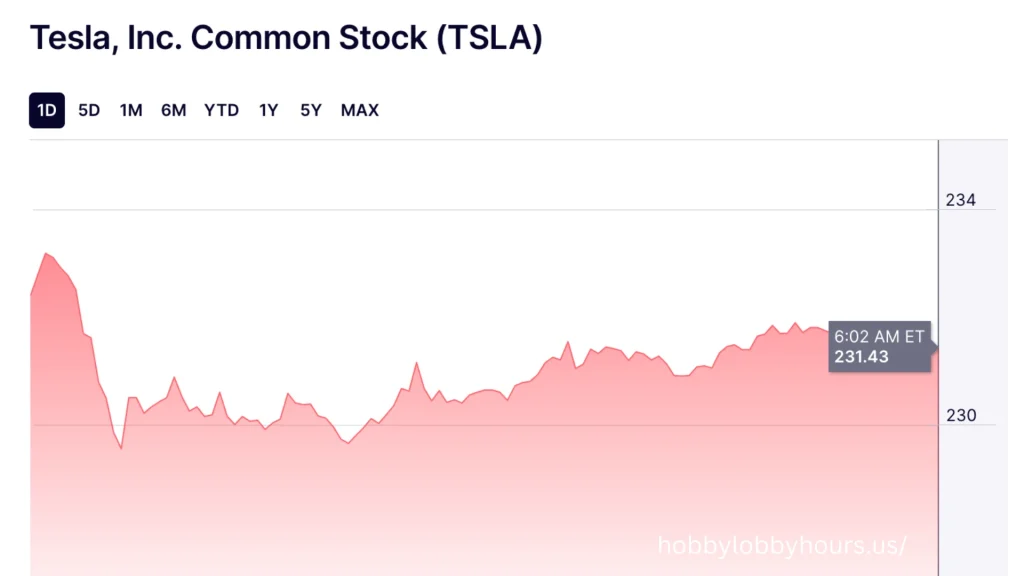

Current Price of Fintechzoom Tesla Stock

On July 23, 2024, Tesla released its earnings report, which states that Tesla reports a 45% drop in profits as AI costs rise and vehicle prices fall. The current price of Tesla Stock is $232.07. The complex Tesla stock can be navigated with the assistance of financial analysts and platforms such as FintechZoom, which provide in-depth information and real-time analysis.

How Does Fintechzoom Tesla Stock Work?

Providing detailed coverage of many financial markets and stocks like Tesla, Google, Apple, etc., FintechZoom is a financial news and analysis site. From Tesla stock performance to market movements to general economic concerns, FintechZoom discusses everything about Tesla.

For new investors and experienced investors alike, the website provides useful information about market trends and earnings releases. It is a great tool for keeping track of Tesla stock developments and investing strategies.

How FintechZoom Can Help You Analyze Stocks

In order to understand the importance of FintechZoom, let’s take a look at a few of its key features:

1) Updates in real time

Getting real-time updates on Tesla stock prices and market fluctuations will help FintechZoom make predictions of TSLA stocks. With the platform’s quick response to market dynamics, investors can react quickly to shifts in the electric vehicle market.

2) An in-depth analysis

A large amount of research of individual stocks includes performance evaluations and predictions for the future. This comprehensive information will allow you to better understand Tesla’s market patterns and stock prices. In other words, you can buy and sell Tesla stocks at the right time to minimize losses and maximize profits.

3) Insights from experts

From financial analysts, FintechZoom provides insightful commentary on market conditions, economic data, and Tesla-specific developments. A well-informed investor can create more complex and well-informed strategies before investing in Tesla. Expert insights can be very valuable when making an investment decision.

4) Concentrate on fintech

Through FintechZoom, investors can find out how new technologies are influencing the financial markets. It provides an overview of the fintech industry’s rapid evolution from traditional finance.

5) Resources for education

Fintechzoom also covers advanced topics such as technical analysis and macroeconomic trends. Educational resources explain important concepts such as asset allocation and diversification principles. Fintechzoom’s website helps investors make informed decisions and confidently navigate the complex financial markets when investing in Tesla.

The 6 most important factors affecting Tesla stock Fintechzoom

A Tesla stock’s performance is influenced by the following six factors:

1) Performance in financial terms

Quarterly profit reports and revenue statistics greatly influence investor confidence. Stock price fluctuations can be influenced by changes in revenue or earnings targets. Tesla’s stock performance was affected by its Q1 2024 earnings, which were in line with forecasts but lower than expected revenues.

2) Figures for production and delivery

Every quarter, Tesla produces and delivers an important number of cars, which is a measure of its operational effectiveness and consumer demand. Stock prices can be directly affected by changes in material availability, such as silicon, gold, titanium, etc. The recent efforts of Tesla to increase the production of cars in Q2 2024 are being closely monitored by investors.

3) Developments in technology

The company has introduced many technological innovations, including autonomous driving and new models like the Cybertruck, which have the potential to influence investor confidence. However, problems like product recalls can harm Tesla stock.

4) Competition within the industry

It is also important to consider the level of competition in the electric vehicle industry. Tesla’s share price and its stock price are affected by the performance of other electric vehicle makers and new competitors. Rivian, for example, is closely observed as manufacturers and startups compete for EV market share.

5) Market and economic conditions

Besides interest rates and world economic stability, Tesla’s stock can be affected by geopolitical unrest or economic downturns that negatively impact consumer purchasing.

6) The influence of Elon Musk

As a result of Tesla’s CEO’s words and deeds, the stock price fluctuates. This can be attributed to statements about new products or even personal actions.

The Future of Tesla Stock – Fintechzoom

Investors and analysts are eagerly anticipating what Tesla stock will do in the years to come. Several factors will impact Tesla’s stock performance:

Expansion of product lines and technological innovation

A significant expansion of Tesla would result from the success of new models like the Cybertruck and Semi as well as advancements in battery technology. As Tesla expands into new markets, it will need to maintain its lead in electric vehicle (EV) technology.

Efficiency and productivity in the supply chain

It will continue to be important to scale production efficiently and manage the supply chain. Tesla has invested in Gigafactories throughout the world, including in the United States, China, and Germany.

It is anticipated that these facilities will increase manufacturing capacity while lowering costs. However, disruptions in supply chains may impact profitability, especially for materials such as lithium and semiconductor chips.

Expansion and competition in the market

With its expansion into overseas markets, especially Europe and Asia, Tesla has growth potential. However, increased competition from traditional automakers and new electric vehicle startups can impact its market share and pricing power. The electric vehicle market is flooded with new entrants from China, General Motors, Ford, Volkswagen, and other major companies.

Diversification of the energy business

It is possible for Tesla to develop its energy sector, which includes solar and energy storage technologies. Developing and deploying products like the Solar Roof and Powerwall are important areas to analyze, as sustainable energy solutions are in demand. Tesla can capitalize on this trend to increase revenue.

Valuations and financial performance

Historically, Tesla’s stock has fluctuated significantly based on quarterly results and general market conditions. Tesla’s financial performance, including revenue growth and cash flow, will be monitored by investors continuously. Tesla’s valuation indicators are also compared to those of its industry peers, such as the price-to-earnings ratio.

Conclusion

For finding information on Tesla stock before investing, Fintechzoom is an excellent resource. In FintechZoom’s Tesla stock analysis, several factors are causing it to be very volatile. Tesla is famous for its electric car inventions. If you want to invest in Tesla, FintechZoom’s coverage and expert analysis will help you choose the right investment.

FAQs

What Makes Tesla So Famous?

One of the most famous names in the automotive industry is Tesla, which produces electric cars that are more eco-friendly.

Is Tesla stock worth investing in?

To buy shares of Tesla, you will need the help of a broker. Tesla’s shares are traded on the NASDAQ exchange under the ticker TSLA.

Is Tesla a dividend payer?

Tesla does not pay dividends despite being one of the world’s largest companies.