How to Ensure Safety During International Money Transfers?

Sending money internationally has become a common undertaking as many individuals live and work overseas. With this increase, security risks and financial safety concerns are also escalating.

If you’re working abroad and looking for ways to make safe and secure transactions internationally look nowhere else. Step into this detailed blog post, where you will discover four tips to send money overseas safely and ensure financial protection.

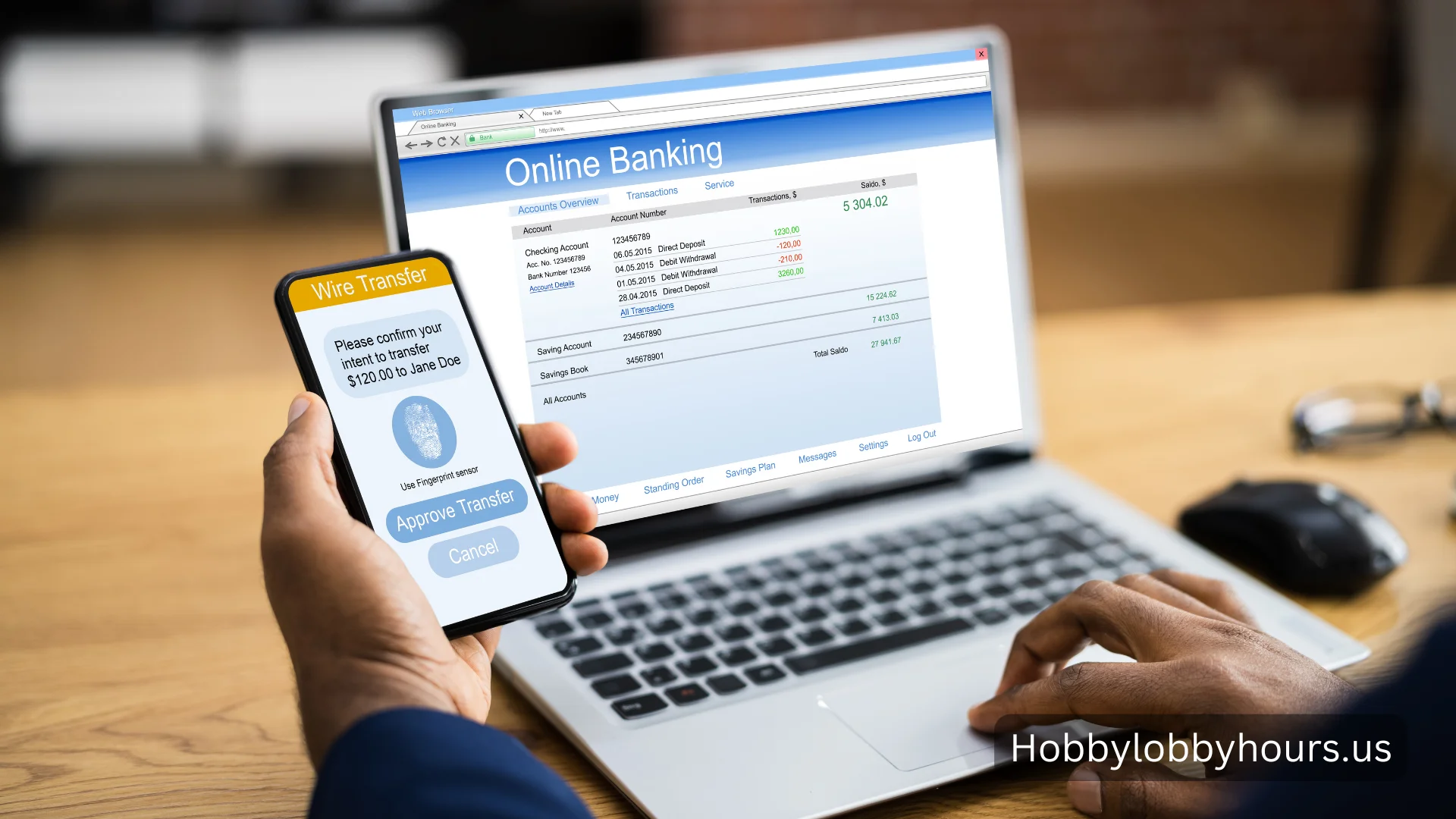

Source: Freepik.com

1. Choose the Option That’s Best Suit Your Needs

The options for transferring money internationally are numerous, such as wire transfers, money orders, bank drafts, and online remittances.

- If you choose wire transfer, open SoFi’s official site to learn how to wire money online.

- If you’re comfortable sending money via bank draft, assess and fulfill all bank needs and demands.

Some money transfer methods are more straightforward but take longer to complete the transaction process. On the contrary, others are more expensive but make transactions quickly and safely.

So, be wise and do meticulous research. Prioritize choosing the one that’s important to you and offer safe and secure money transfers abroad.

Also check: Money6x.com Building Assets

2. Find and Compare Exchange Rates and Fees

Next, you need to browse multiple money transfer platforms to find the best exchange rates and fees associated with them. Currency exchange rates can vary based on various factors, such as the platform you choose, where you send money, and so on.

Even a slight variation in exchange rates can make a huge difference, especially when sending money in large sums. Different money transfer platforms offer currency conversion tools. Leverage them to get an idea about how much your recipient will receive once a transaction is made.

Additionally, transfer costs may vary because all money transfer service providers set their own fees. To estimate the overall cost of international money transfer, you should ask several things;

- Will you get the real-time exchange rate?

- Which fees will you have to pay (upfront, hidden fees, or both)?

- How much will your recipient receive?

Once you get satisfactory answers to these questions, you will feel more confident choosing a money transfer firm that offers the best exchange rates at a low cost. Therefore, the likelihood of financial loss will be reduced.

3. Always Use Safe and Secure Internet Connection

When making international transactions, prioritize using a safe and secure internet connection. Refrain from using public Wi-Fi networks; otherwise, hackers can easily intercept your personal information.

Instead, opt for a private, password-protected network. For added security, consider using a virtual private network (VPN). Making this wise move will help safeguard your sensitive data as it travels online.

4. Verify the legitimacy of the Sender and Receiver

Before you initiate any transfer, invest time verifying both the sender’s and receiver’s identities. Look at official documentation, such as business licenses or government-issued identification, if you’re dealing with companies or individuals, you’re not familiar with.

This is particularly important when making overseas transactions where the regulatory landscape may differ. Always get in touch through official channels. This way, you can confirm details before proceeding with the transfer.